What Are The Benefits Of Using Direct Deposit For Your Finances?

Payments are made instantly and easily with the increasing convenience of Direct Deposit. Your money is directly transferred to your bank account on payday, saving you from struggling with long bank lines and paper checks.

Employment payments and Government benefits are now preferred to be made through this simple method. Direct deposit, being straightforward, offers financial flexibility, reduces the risks of theft, and also saves time. Main advantages of Direct Deposit include immediate access to your funds and improved budgeting.

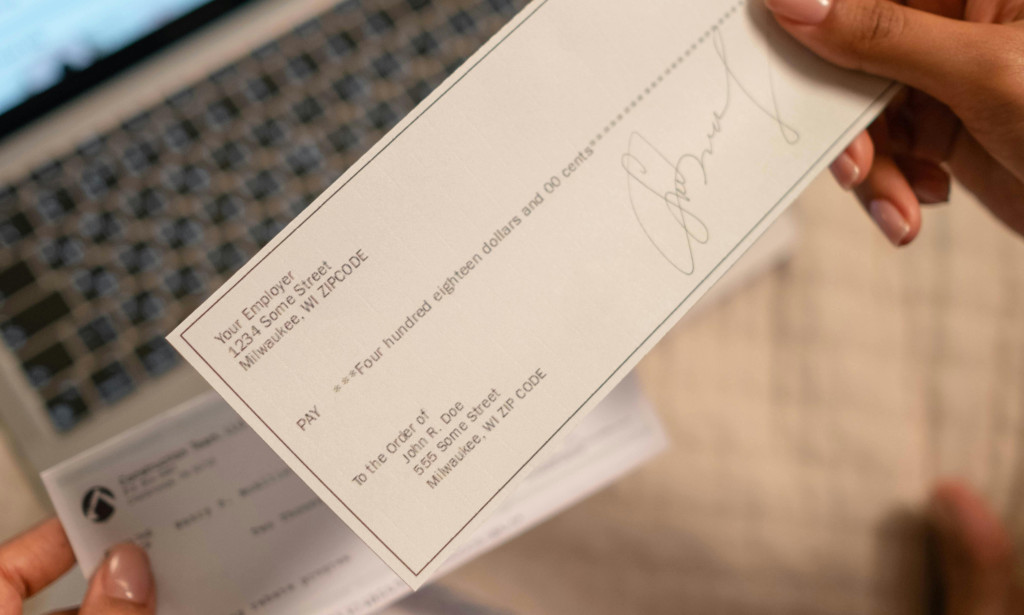

In this article, we will explore theDirect Deposit definition, its Benefits, and its comparison with paper checks. If you are still using paper checks, then this blog will help you determine that moving toward direct deposit is a wise financial decision.

What Is Direct Deposit?

The process of electronically depositing money into a bank account rather than using a paper check is known as Direct deposit. Direct Deposit is frequently used for government benefits, wages, tax refunds, and investment withdrawals. The recipients must provide their bank details to the payer to receive a direct deposit.

Direct Deposit is frequently used by employees, government organizations, and private companies because it is quick, trustworthy, and affordable. Considerably, direct deposit has emerged as the standard for modern payments due to its security and convenience.

What Are The Key Benefits Of Direct Deposit?

Along with its ease of use, direct deposit offers numerous financial and lifestyle benefits. This form of payment has entirely transformed how people manage their financial affairs, offering faster access to their money and enhanced security.

Let us take a more detailed look at the primary positive aspects:

- Direct deposit helps to Increase Security and safety.

- Make Automatic Bill Payment possible.

- It's Paperless and Friendly To Ecology and the Environment.

- It's convenient and time-saving.

- Keep Financial Tracking And Record Keeping.

Direct Deposit vs Paper Checks:

Although they both transfer your earnings, direct deposit and paper checks are very different in terms of convenience, reliability, and security. Here are some features discussed covering the key difference between them:

FEATURES |

DIRECT DEPOSIT |

PAPER CHECKS |

|

Security |

Transfer is password-protected, and nothing material to lose. |

Checks can be lost, faked, or stolen. |

|

Speed |

Funds are readily available and transferred. |

Funds are not readily available and need more processing. |

|

Convenience |

It is a 💯 computerized and online platform. |

The checks must be deposited by the recipients. |

|

Cost Price |

Its cost fee is minimal or zero. |

Expenses include check supplies, printing, shipping, and bank fees. |

|

Accessibility |

It requires a proper bank account to transfer or receive funds. |

Checks can be cashed without an account, but usually less convenient and may involve extra fees. |

|

Environmental Friendly |

It's a paperless transaction and extremely green. |

It's not environmentally friendly and spreads paper scraps. |

|

Record Keeping |

Tracking and analyzing the digital record is effortless. |

Physical scraps must be maintained and arranged. |

|

Reliability |

It is not affected by severe weather, office closure, or mail delays. |

It is likely to be lost in transit or postal travel. |

Conclusion:

Direct deposit has replaced paper checks due to its speed, security, and reliability, and is considered the first choice for payments today. With automatic transfers and transparent electronic records, it provides instant access to money, lowering the possibility of loss or theft, and aids in improved budgeting. In contrast, however, paper checks are less convenient, slower, and less secure.

For a large percentage of people and businesses, direct deposit is the far better option. Switching the transition to direct deposit can provide long-term financial ease and peace of mind to anyone who is still using paper. Employers benefit from the reduced expenses, less administrative work, and a more modern wage procedure when they move to direct deposit.

You must be logged in to post a comment.